After quite some time coming up with a small cap coverage. The last one was ION exchange which is still available at recommended price after moving up 20% quickly. Maintain the strong view on it for long term.

This time the two stocks which i am covering are in the education sector with the best distribution networks and brand name which gives them a distinct advantage to tap into all high growth verticals in the education sector.

Camlin Limited is a 200 crores market cap and Navneet Publications at 1100 crores market cap.

As of now it would take more time to elaborate on business projections of both the company as busy with lots of other work. For now just a quick dope on the two stocks.

Camlin Limited:

1) Have a look into the analyst meet presentation of the company which shows the intent of the company to enter growth areas in education sector being Play schools

- https://www.camlin.com/corporate/pdfs/presentation1.pdf

2) The company is in existence from 1930s and listed from 1988 with an excellent brand name.

The most important thing to note is company plans to expand its play school division Alpha Kids. It already has 3 schools and is a 100% subsidiary.This requires company to raise more money internally/externally which generally implies company takes shareholder friendly decisions:). Also the other divisions continue to give stability.

I would suggest investors to go through the annual reports/presentations posted on the company website.

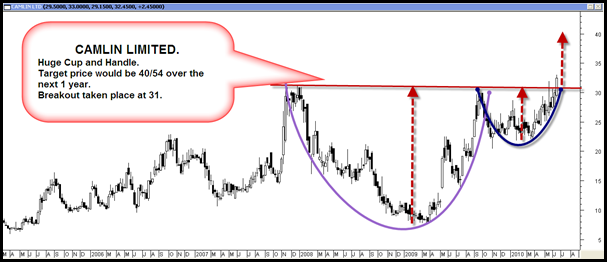

Technical View:

Excellent Cup and Handle pattern which gives a target price of 40/54 over the next 1 year.

Disclosure:

Long term delivery call initiated at 28-29 and added more at 31 in all our plans namely – Quickgains Premium/Delivery Gains.

Navneet Publications:

The only big brand in the stationery products with a nation wide distribution network.

Dividend yield of 5% makes it even more stable in the long run.

Will soon put a detailed view on the business.

Technical View:

The stock has been range bound from 45-55 in near term. The zone of 45-50 is an accumulate area with a long term view. The stock should target 65/80 levels in the long run.

Both the above stocks should be taken with a view of 6-12 months.Accumulate on every dips.Will put in more details as soon as possible.

Regards,

Nooresh

June 18, 2010

SIR , YOUR VIEWS ON GMDC , ITS GROWTH PROSEPECTS , TARGETS OVER 1-2 YEARS.

THANKS

June 19, 2010

Hi Jumani,

Its a good story provided one has patience to stick with it. Near term outlook is a big resistance at 140-150.

June 18, 2010

your views and tar for geojit financial for long term , no movement seen , but daily comin down

regards

June 18, 2010

hello nooresh, your views , targets , advise for rajesh exports for medium and long term say 2 years….

plz reply

shilpa

June 18, 2010

hello norr, your esteemed views on geojit financial , targets and scope for 1-2 years , the stock is slowly decling unlike peers ,kindly advise

June 19, 2010

Hi Komal,

I would prefer to avoid Geojit at current levels and wait for more declines.

June 18, 2010

Hi Nooresh,

Thanks for your small caps recommendations. You have mentioned earlier in this post that ION exchange shot up 20 % and now its back to the recommended price. Can you please share that post with us. I am unable to locate the link of the same.

Sanman

June 19, 2010

Hi Sanman,

https://nooreshtech.co.in/2010/04/small-cap-coverage-ion-exchange-water-story.html

Its a stock only for long term investors.

Regards,

Nooresh

June 19, 2010

Hi Nooresh,

Your views on Shri Lakshmi Cotsyn fundamentally & technically for 1 yr.

June 19, 2010

Hi Vivek,

Its a good stock fundamentally. Buy on dips only.

Regards,

Nooresh

June 20, 2010

Hi Nooresh,

Your views on Shri Lakshmi Cotsyn fundamentally & technically for 1 yr.

I had purchased 2000 @Rs.200 in 2008 .

Should I hold or sell it. Give me targets.

June 19, 2010

Hi nooresh,

classic pump and dump technique being seen in scrip “austin engineering” (BSE CODE 522005) since yesterday. Sms from numerous dummy no’s got circulated for the scrip in last couple of days and seems innocent investors are getting struck in it..

June 19, 2010

Hi Manav,

Even i got 3-4 sms :). Right now the pump up is on. Dumping will start from Monday.So take care or rather take a risky short:)

Regards,

Nooresh

June 19, 2010

hI nooresh

Can you give your views on polymedicure on short n medium term basis.. Few other stocks as ksbpumps, deccan chronicle n anathraj.

June 23, 2010

sir i bough bankbaroda 100 shares @717 can i hold any s/l and target

June 24, 2010

hi

sirji your view on camlin & navneet is so good

June 25, 2010

Very positive but for the long term investors. Near term partial booking in Camlin

June 25, 2010

Hi Nooresh,

Your views on Shri Lakshmi Cotsyn fundamentally & technically for 1 yr.

I had purchased 2000 @Rs.200 in 2008 .

Should I hold or sell it. Give me targets.

June 25, 2010

I would suggest hold but some dips from current levels is possible

June 25, 2010

Hi Nooresh,

Your comment on Camlin is fine. But wait & see what is going to happen.