Peak to Bottom drop in various major Indices.

CNX 100 - Down 13.7%

CNX 200 - Down 13.8%

CNX 500 - Down 13%

CNX Auto - Down 16.3%

CNX Bank Index - Down 22.4%

CNX FMCG - Down 12.8%

CNX IT - Down 11%

CNX Midcap - Down 10.7 %

CNX Nifty - Down 15.6%

CNX Pharma - Down 8.6%

CNX Smallcap - Down 17.7%

BSE DOLLEX 30 - Down 21.1%

Nifty is now almost lower than what it was on 1st September 2014.

We are just up 7% from the closing price on the Election day result ( Nifty 7203 )

The part which is interesting is Midcap and Smallcap Index have fallen almost similar to Nifty and lesser than the Bank Nifty as well as they recently made a new all time high unlike Nifty. So over the last 1 year it has been midcaps/smallcaps which have performed better and could be so in the future.

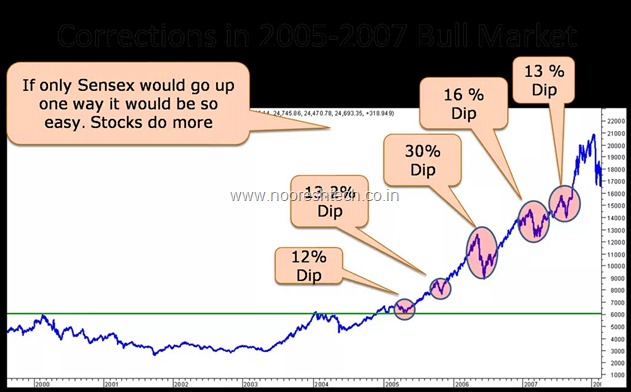

Such corrections are normal and can get deeper too at times but its all about whether you can digest them as an investor and just stay safe as traders ( its volatile )

On a technical perspective we have gone into oversold zones and we need to see positive divergences on RSI on a bottom retest.

Its tough to catch a bottom or a top exactly unless you are lying 🙂 or bragging !

This is my technical view explained in a video - https://www.youtube.com/watch?v=11VMlec3vvs

There will be a lot of people talking about 6800/7200 and if we go to 7500 we will see a talk about 6400 too 🙂 . That is how market sentiment works. As an investor these are real good times if you believe in the long term Bull Market in India ( I do )

As a trader one needs to watchout for divergences and reversals to confirm a trend change. Till then its better to be on the sidelines or trade on lower size as volatility will be high.

Personal View -

My focus has been Midcaps/Smallcaps over the last many years and more so in last couple of years so Nifty is not which bothers me a lot on my decisions unless there is a strong risk-reward trade on it or on large caps.

But technically looking at a retest of 7500-7700 zone as a good place to get in with a positive divergence on RSI and other indicators. Also one needs to be ready to digest some further dip beyond that but dont expect it to sustain there for long.

A lot of price movements in markets define the thought process. So a fall in markets leads to numbness and dumbness. All the gloating about Reforms in 2014 is now changing to Deformed Economy 🙂 - All the Modi faced reports now changing to Bear Case Reports with Downgrades 🙂 .

So for some this fall is Scary and for some others its an Opportunity - You need to decide for yourself 🙂

Like i have mentioned before if you get a trend right its more about Allocation then Selection.

Sticking my view out- If you have a 3-6-12-18-24-36 months view then next few days/weeks are a good time to increase equities as part of your Networth !!

Good time to go accumulating stocks with a mix of quality and even some risky bets in small size.

September 2, 2015

fantastic Nooreshbhai

you are perfect……..no body can pridict a perfect bottom n as you told us always MARKET IS ALWAYS WRITE….but I agree with you to start investment now n as market falls…..good luck

September 3, 2015

Sir as per my Technical analysis i strongly believe that nifty will come to 6500 levels & Bank nifty to 13000 levels.

I’m 100% sure on my analysis.

Time will give us answers.

Have a gr8 life ahead.

September 4, 2015

Well my view is clear as to not looking at 6500.

But am never sure about anything in markets. Ready to accept what market shows 🙂

Cheers.

September 13, 2015

sir your view on RCOM and ADSL