Another Index we keep looking at for insights is Nifty50 Equal Weight.

( We look at a lot of them – BSE Smallcap, Dollar Index, Global Indices etc. We cover a few of these in our Weekly Insights )

Why to look at Nifty50 Equal Weight ?

- The more concentration of weights into a few names in Nifty50 makes it important to confirm a Breakdown, Breakout and Leadership Change.

Top 5 stocks – Reliance, Infosys, HDFC Bank, ICICI Bank, HDFC, = 41.75% of Nifty.

Top 10 stocks constitute 58.48% of the Nifty

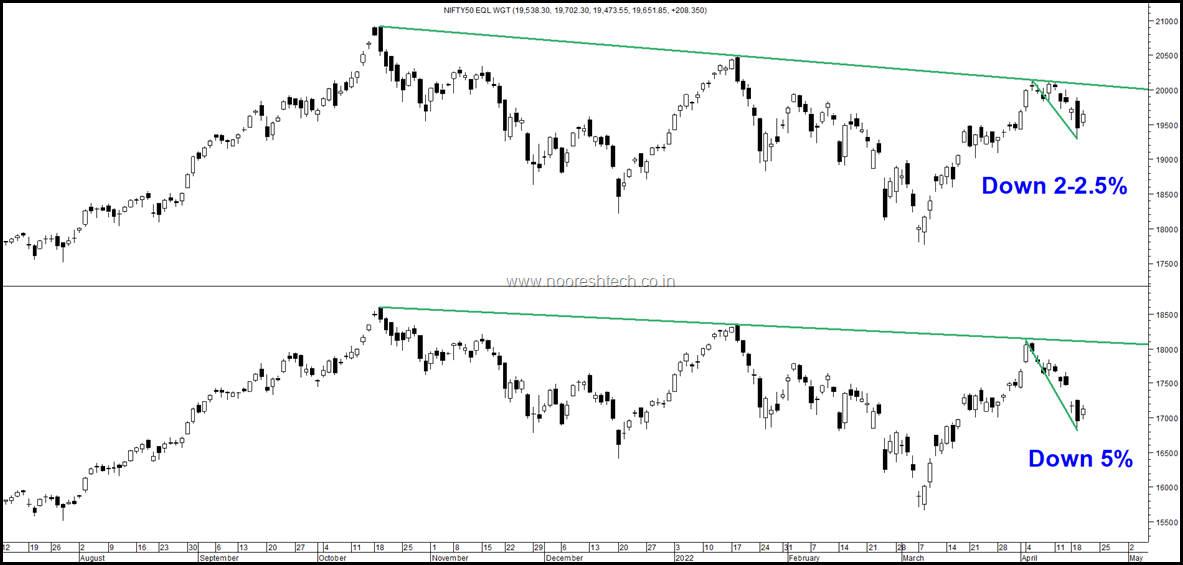

Look at the current move. Direction is similar but current downtick is lower in Nifty50 EqualWeight

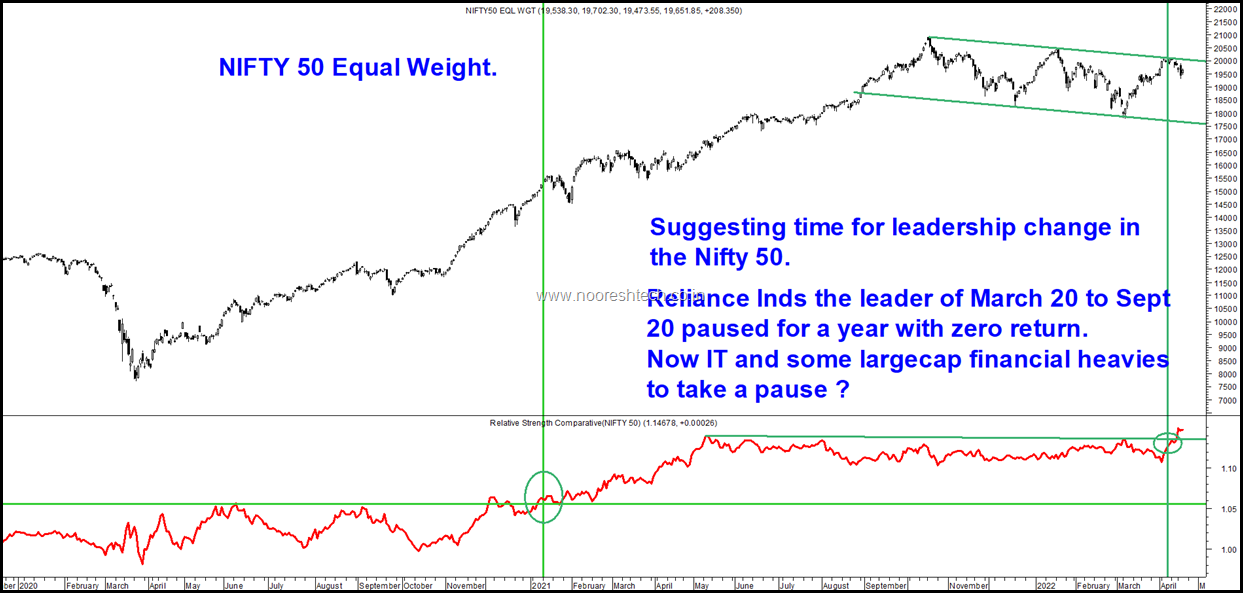

- Very few times does the Nifty50 EqualWeight start showing relative strength or relative weakness in a big way with Nifty50

The last time it started showing Relative Weakness was in 2018 where Nifty50 Equal Weight did not make a new 52 week high. Nifty from Jan 2018 top of 11121 made 3 more new highs 11700, 12100, 12400.

A few heavyweights continued to do better whereas Nifty50 Equal Weight and all other indices including Smallcap/Midcap Indices continued to drift lower.

- Nifty50 Equal Weight breaking out indicates a shift in leadership.

The last time Relative Strength broke out in Nifty50 Equal Weight was in end of 2021.

That was the time we saw Reliance lose leadership and go nowhere for next 1 year but other stocks took leadership.

The current breakout in Relative Strength suggests a leadership change is the thing to watch out for. IT and some largecap financials could be losing leadership and new sector/stocks can be the leaders.

So how do we look out for what could be the new leaders.

Look for stocks/sectors showing relative strength breakouts with Nifty50.

Conclusion

- New leadership in Nifty50 is to watch for.

- Reliance Inds near an all time high can be one of the leaders.

- PSUs showing relative strength.

- Select stocks showing relative strength M&M, Axis Bank, SBI, UPL, Bharti Airtel and can take leadership.

SOME MORE IMPORTANT UPDATES

1) TECHNICAL ANALYSIS TRAINING MUMBAi – May 14-15

Duration:

2 days

Date:

14-15 May 2022

Timing : 9.30 to 6 pm.

Max 10-12 participants

Location:

Hotel Karl Residency, Andheri, Mumbai

Fees:

Rs 16000

Bonus:

Get access to the Online Tecnical Analysis Video Course for 1 year for free.

Content - https://nooreshtech.co.in/technical-analysis-training/classroom-training

Payment link to register:

https://imjo.in/Kkpd5w

For any queries email nooreshtech@analyseindia.com , Whatsapp 7977801488 or call 9833845334 Harsh

2) FY22 Performance Update – Technical Traders Club

The Recommended one for most readers.

3) Job Opening at NooreshTech

We are looking out for a Full-time role with NooreshTech Please read the details carefully and send your CV to nooreshtech@analyseindia.com Also, interested candidates please read about our work on http://nooreshtech.co.in