There was a time many years back when we would see a jump up in last 30 minutes of a Quarter End or Year End in Nifty or in certain illiquid stocks with high institutional holding. This was to prop up the NAV.

The current structure of the market has changed to automated ETF Flows and we are now starting to see high volumes in last 30 mins on the last day of the month.

Will keep this a small post with a few charts.

FII Figures

-8300 cr on 26th Feb

-5930 Cr on 29th Jan

+7700 cr on 27th Nov

-3395 cr on 31st Aug

Lets look at the price action in last 30 mins on last 2 instances.

Nifty - A 100 point down tick in 3-5 mins and 200 points in last 20-30 mins on 29th Jan and 26th Feb

29th Jan 2020. - 1 day before budget

100-200 points down between 3-3.05 pm.

200 points from 3-3.30 pm.

26th Feb 2020 -

Down 80-100 points in 3 mins after 3 pm.

Down 200 points in last 20-30 mins.

What is interesting is - Not a similar downtick in any of the global indices in those 30 mins !!. That confirms its a ETF trade.

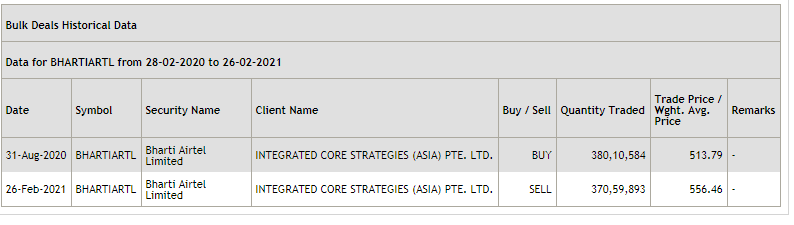

One interesting ETF trade which has created huge volatility - Bharti Airtel.

A counter party for most MSCI rejig is Integrated Core Strategies ( ASIA ) PTE Ltd.

Bharti Airtel - A Contrarian Bounce and Breakout?

Bharti Airtel - Chart

Research Service

Technical Traders Club

Check Link for full details

https://nooreshtech.co.in/quickgains-premium/technical-traders-club

Subscription Link

Half Yearly = Rs 15340. ( Including GST )

Annual = Rs 25960 ( Including GST )

Insider Trading Subscription Link

Quarterly Report Payment Link - https://imjo.in/Mzmtdt

For Annual Subscription – Insider Trading Quarterly Report - https://imjo.in/JtdFVs

DISCLOSURE Nooresh Merani

SEBI Registration disclosure – Research Analyst INH000008075 Investment Adviser ( INA000002991)

Financial Interest:

Nooresh Merani and his family/associates/ analysts may have exposure in the securities mentioned in the above report/article.

Nooresh Merani and his family/associates/ analysts does not have any financial interest/beneficial ownership of more than 1% in the company covered by Analyst.

Nooresh Merani and his family/associates/ analysts have not received any compensation from the company/third party covered in the above report/article ever.

Nooresh Merani and his family/associates/ analysts has not served as an officer, director or employee of company covered in the report/article and has not been engaged in market making activity of the company covered in the report/article.

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

Also read the detailed disclaimer - http://nooreshtech.co.in/disclaimer