This has been one of the most hated sector and rightfully so given the terrible price performance over years and decades.

Every time the trend seems to be changing the momentum fizzles out.

So why are we looking at it ?

- The Sectoral Index has been knocking at the same resistance a few times and is close to a breakout.

- The Risk-Reward is great.

Very recently we looked at Metals and how the rally has surprised everyone.

Not as convinced on PSE but the trade is on given the risk-reward. So will look out for a follow up in the names.

NIFTY PSE INDEX

- 2600-2650 a major resistance.

- Trending up and sustaining above the lower trendline supports.

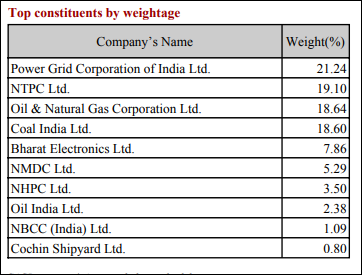

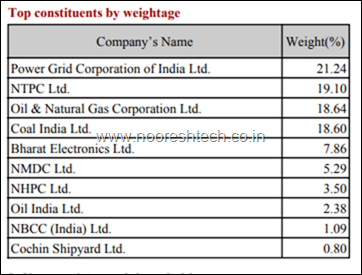

Top Constituents

NIFTY CPSE

- The Big resistance at 1500-1530.

Technical Charts for the Top Names

PowerGrid

- 182-183 a major resistance.

- The 180 mark has been a cluster zone of problems since a long time.

- Pre-emptive trade with a stop at 170.

NTPC Limited

- A good base at 82-85.

- Dips can be a risk-reward entry.

- Stops at 85. Major momentum above 100-105

Coal India

- Good base at 125-130.

- Volumes in last 2-3 days.

- Sustaining 140 would be further confirmation.

NMDC

- Trending well after the breakout at 86-88. ( Disclosure – Recommended in Technical Traders Club )

- Further momentum above 95-97.

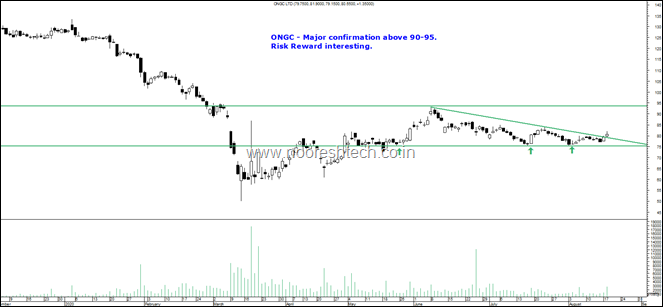

ONGC

- Major confirmation above 90-95.

- Too early to confirm a trend change but risk-reward is good.

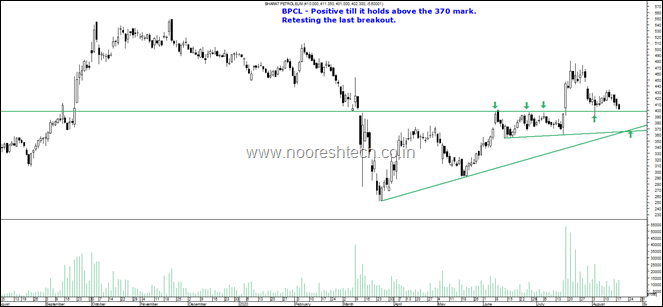

BPCL

- Retesting the recent breakout.

- Positive till it holds above the 370 mark.

- A move above 435-440 would be a confirmation of momentum.

HPCL

- Very close to the support of 200.

- Reversal on sustaining 225-230. Risk reward bet.

Conclusion

- The PSE and CPSE index is very close to a resistance and a breakout beyond that would be a confirmation of a trend change to upside.

- The trade is to either pre-empt with a very small position and a strict stoploss. Add whenever the price confirms and shift stoplosses higher.

- The Breakout if happens has a huge reward given the terrible underperformance of the sector.

- The Risk-Reward is good. Price action in coming days would confirm if the breakout does take place or not.

Brief Video on Product Offering – Online Video Course and Analyse with Me -

After receiving a lot of inquiries,Have created a small video explaining the course offerings

Online Technical Analysis Video Course https://youtu.be/fJYX1TP0a6I

Analyse With Me – A Practical Approach to Technical Analysis https://youtu.be/K92k4V_BAaY

Advisory Services

Technical Traders Club https://nooreshtech.co.in/quickgains-premium/technical-traders-club

QuickGains F&O - https://nooreshtech.co.in/quickgains

August 21, 2020

..