Nifty is back to 9700 after 4-6 weeks. In our last update around 9700 had mentioned the dip as a buying opportunity which worked out well - Nifty Index View and Other Indices–Correction or Trend Change ?

So now that we are back to 9700 and testing the previous bottom lets look at Nifty and other Indices again.

Nifty Technical View

- The recent top at 10179 was marginally higher than the previous top of 10138 with a Negative Divergence on RSI.

- The last bottom at 9685 retested the previous breakout zone of 9700 and bottomed with a classical doji.

- We are back to 9700 in much quicker time compared to the laborious move from 9700 to 10178 which is not a good indication of strength.

- Sloping Trendline breakdown seen indicating momentum has started reducing.

- Still in a Higher Top Higher Bottom Formation but a sustained move below 9650-9700 would change that structure and the short term trend.

- Given that its a retest of supports in faster time the strategy this time would be to wait for further price action. Also look for indications on other broader market indices.

- Although again a pullback trade would have a strict stoploss at 9650 but not with a similar conviction like last time.

- The previous two bottom supports at 9450/9340.

Bank Nifty Technical View

- Similarly placed around previous bottoms but Bank Nifty did not make a new high.

- The previous two bottom supports at 23000/22500.

Nifty 500 Technical View

- This is an interesting Index with a much larger number of stocks in it and well diversified compared to the Nifty 50 were top 20 weights are almost 70-75% of the Index.

- Nifty 500 is still in a higher top higher bottom formation and a bit above the previous bottoms.

- This suggests the trend is still pretty strong in the broader market.

Nifty Next 50 Technical View

- This is another interesting index which has the next 50 stocks after Nifty 50. This has generally outperformed the Nifty 50.

- Again a Higher Top Higher Bottom Formation with much stronger upmoves in comparison to Nifty50.

- It is still away from the previous bottoms and has not even broken the sloping trendline.

- Suggests the trend is still strong in a lot of largecaps beyond the Nifty50.

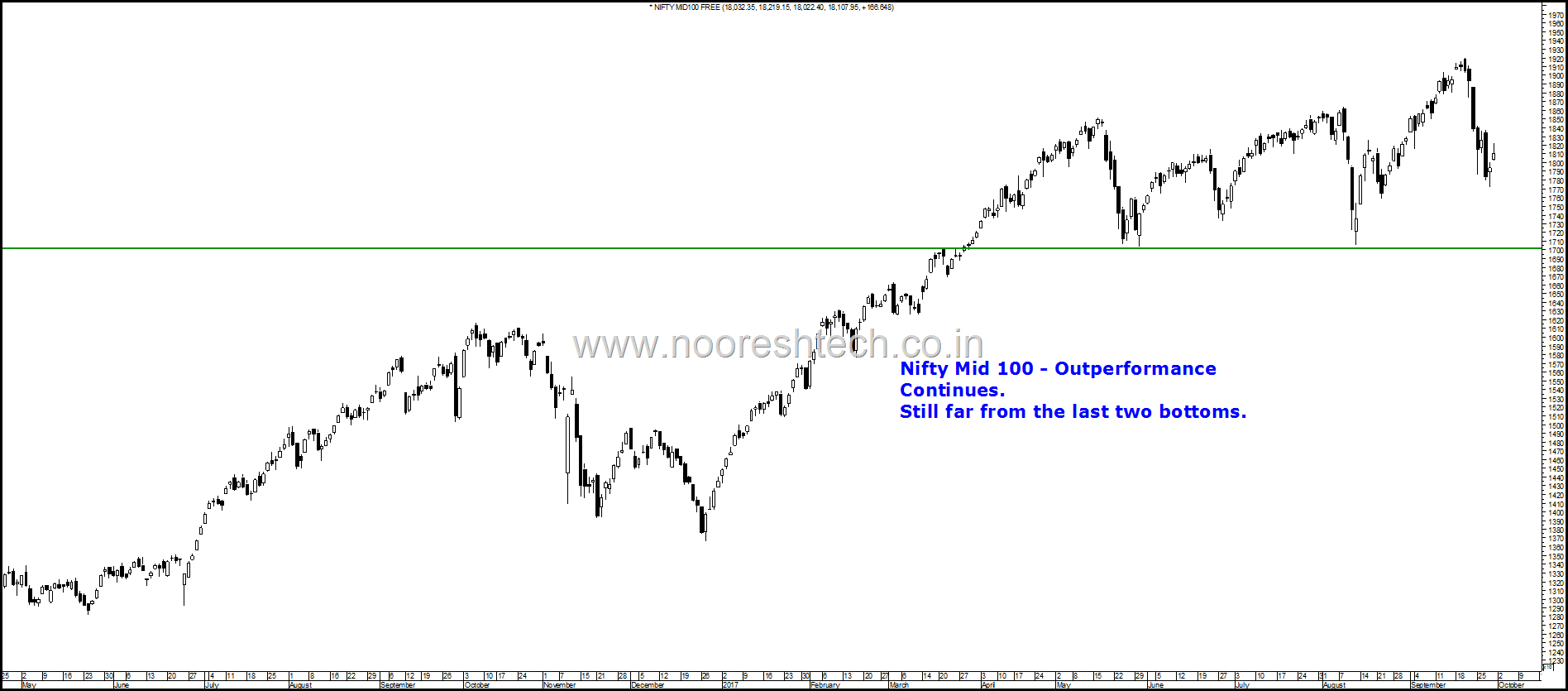

Nifty Midcap 100 Technical View

- The outperformance in Nifty Midcap 100 continues with much stronger moves to the Nifty50.

- Higher Top Higher Bottom Formation and still far from the last two bottoms.

- The Midcap 100 Bottoms at 17000 was made in May 2017 ( Nifty equivalent 9340) & August 2017 ( Nifty equivalent of 9685)

- The Midcaps structure still looks positive.

Nifty Midcap50 Technical View

- Very similar to the Nifty Midcap50 with strong trend.

Nifty Small 100 Technical View

- The Nifty Small 100 outperformance continues with much stronger moves to Nifty 50.

- Higher Top Higher Bottom Formation and still far from the last two bottoms.

- The Nifty Small 100 Bottoms at 6900 was made in May 2017 ( Nifty equivalent 9340) & August 2017 ( Nifty equivalent of 9685)

- The Smallcaps structure still looks positive.

Conclusions

- Nifty is yet to confirm a short term topping out or a Trend Change but the broader market indices are still in strong uptrends but nowhere close to diverging with the broad index.

- Most of the broader indices are above their supports and in strong uptrends. Unless further price action breaches those supports like 17000 for Nifty Midcap 100 or 6900 for Nifty Small 100 one should continue to look for stock specific opportunities on the long side.

- Time to look out for new sectors and emerging trends.

While talking about divergences and trends in Smallcaps in comparison to Nifty 50 lets take this chart of Nifty Small 100 in 2015-2016 in which Nifty 50 corrected from 9100 to 6900 but Smallcaps was very resilient.

Are we going to get into a similar time frame where Nifty does not have strong trends but many stocks and sectors did well like Textiles, Chemicals did really well in that time frame.

Will try to update any new sectors which come up to be interesting. We continue to like Fertilizers.

Online Technical Analysis Training Session.

Part 1 : Online Technical Analysis Training. Trainer : N S Fidai

6-8 hours.

The session will be conducted on 8th October from 9.30 am to 4.30 pm. www.wiziq.com would be the webinar provider.

Additional Reading Material, Examples, Videos.

The Webinar Recording will be available on the website for next 3 months.

Part 2 Trainer – N S Fidai/Nooresh Merani

Recorded Webinar ( may also be live if possible)

Technical Analysis is not Just About Trading

2-3 hours.

Part 3

Question and Answer Session Trainer : N S Fidai /Nooresh Merani /Ankit Chaudhary

After 2-4 weeks of the first session a Q&A session for 1-2 hours.

Part 4

30% Discount on Classroom Technical Analysis Training ( Valid for 1 year )

Language of Communication – English/Hindi.

(Going ahead we may plan a session in Gujarati and another in Hindi. )

Trainers – N S Fidai and Nooresh Merani

Fees : Rs 8000

Payment Link

https://www.instamojo.com/nsfidai/online-technical-analysis-course-on-october-/

All the details regarding the login link on www.wiziq.com will be mailed.