Sensex Technical View:

The last few trading sessions have been in a very very narrow range.

The lows of the last 7 sessions have been as followed.

17874 – 17855 – 17897 – 17858 – 17892 – 17856 – 17848.

It seems the index is moving on an Auto Pilot 🙂 mode. Maximum height 18000-18040 and lower side 17850.

So for near term as a trader i would like to keep a watch on the above two levels to give the next direction which could either be 18400 or a move to 17400 zone.

In the meanwhile Stock Specific moves have been spectacular. BSE Small cap has hit new highs though not by a big margin.

So we might be in the zone of some smart moves in small caps but investors/traders need to take care and be very selective with strict discipline.

Stocks to watchout for:

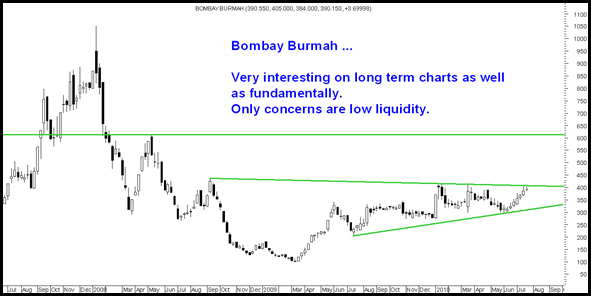

Again i would need some help from Fundamentally Sound people to have a look into the following company – Bombay Burmah Trading Corporation

Interestingly placed in the sector and seems pretty much an interesting bet with businesses ranging from tea,coffee,rubber, laminates.

Also possible Land Bank and one of its subsidiary companies Leila Lands holds Britannia Limited. As well as various subsidiaries under Bombay Burmah hold interests in other Wadia group companies. A detailed study on the same would give a fair idea. Current Market Cap of 550 crores is at a good discount to value of holdings and businesses.

Will try to do more research by the weekend and hope if some of the readers can help.

Technically the stock looks set for 600 + levels if able to breakout above 420 in near term.

Sujana Towers:

Generally a high risk stock so do your own research.

Stock could give a sharp move in short term if closes above 61/

Regards,

Nooresh

July 21, 2010

Dear Nooresh,

Also worth tracking is Petronet .Above 88/- it could target 120/-.

One more is Venus remedies. but only on close above 295/- with volumes.

regards,

Himanshu.

July 22, 2010

Yes Petronet watching it for quite some time now.

Venus Remedies will have a look

July 21, 2010

Again IFCI looks good for the week with results on 23rdjuly and expiry on 29th with a weekly target of 65-67.

July 22, 2010

IFCI continues to remain a good bet in medium term.